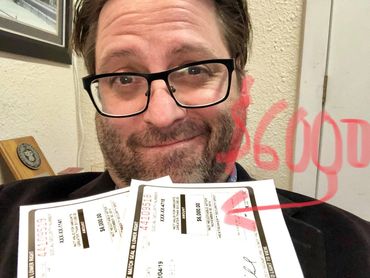

Why Is FreedomTAX expecting such large refund this year?

What documents do I need for to prove I qualify for EIC?

To prove the child lived with you in the United States, the document(s) must have:

● your U.S. address, your name, and the child's name. (If you use a P.O. Box as your mailing address, you must send a completed Form 1093, P.O. Box Application stamped by the Post Office)

● the dates in 2022 the child lived at the same address as you must cover more than half of 2022

● if the document has the child's name and your address but not your name, you need to send in another document with your name showing the same address

You can send one or more of the following documents to prove the child lived with you for more than

● school records (you may need to send one or more school records)

● Medical records from doctors, hospital or medical clinic (immunization records may not include all the necessary information)

● adoption or child placement documents

● court records

Or, send dated statements on letterhead from:

● the child's school

● the child's childcare provider (not a relative)

● the child's health care provider, doctor, nurse or clinic

● a social service agency

● a placement agency official

● your employer

● an Indian tribal official

● your landlord or property manager

● a place of worship

● shelters

What documents do I need for to prove I qualify for EIC?

Each child that you claim must be related to you in one of the ways listed below. If the child is:

Then, send in copies of:

Your son or daughter (including an adopted child)

If your name is not on the child’s birth certificate, send us other records or documents proving you are the parent such as adoption records, court decree or paternity test results. If the child was not born in the United States, we need a copy of the birth certificate or immigration papers in English or a copy of the legal translation.

Your grandchild or great grandchild

One or more birth certificates or other legal documents proving how you are related. For example, If you are claiming your: ● Grandchild, send your child’s and grandchild’s birth certificates ● Great grandchild, send your child’s, your grandchild’s and your great grandchild’s birth certificates If the names aren’t on the birth certificates, you need to send another type of document such as a court decree or paternity test results

Your niece or nephew

One or more birth certificates or other legal documents proving how you are related. For example, the child’s birth certificate, showing your brother as the father, your brother’s birth certificate showing your mother’s name and your birth certificate showing your mother’s name. If the names aren’t on the birth certificates, you need another type of document such as a court decree or paternity test.

Your brother, sister, half brother, or half sister

One or more birth certificates or other legal documents proving how you are related. For example, If you are claiming your half[1]brother, you need your brother’s birth certificate with the name of your mother or father and your birth certificate with the name of the same mother or father. Both birth certificates must have the name of the parent in common. If not, you need another type of document, such as a court decree or paternity test results.

Your stepson, stepdaughter, step-brother, step-sister, step-grandchild, or step-great grandchild

One or more birth certificates or other legal documents, such as court papers or marriage licenses, proving how you are related. If the birth certificate doesn’t have the name of the parent to prove how you are related, you need another type of document, such as court decree or DNA test results.

A child pending adoption

If the adoption is not final, you need a statement on letterhead from an authorized adoption agency.

Your foster child placed with you by an authorized placement agency

A statement on the letterhead of the authorized placement agency or the court document placing the child with you during 2019.

Age of each child that you claim is:

Then, send in copies of:

Under age 19 at the end of 2019 and younger than you (or your spouse if filing a joint return)

Nothing at this time.

● age 19 but under age 24 at the end of 2019, and ● a full-time student for any part of 5 calendar months during 2019, and ● younger than you (or your spouse if filing a joint return)

● School records showing the child was considered a full-time student for any part of five months of the tax year. It can be any five months of the year. The months do not have to be consecutive. ● The school records must show the child's name and the dates the child attended school during 2019.

Any age and permanently and totally disabled at any time during 2019

A letter from a doctor, other health care provider, a social service program or government agency verifying the person is: permanently and totally disabled. To be permanently and totally disabled for EIC purposes, the condition must last or be expected to last continuously for at least a year or is expected to result in death; and the person can’t work or perform other substantial gainful activities.

Important things to check before sending copies of your documents to us:

- Your records and documents prove all three; the child lived with you, is related to you and is a certain age. If not, we cannot allow your claim for EIC.

- Your documents are for 2022 not the current year.

- If your documents are not in English, you are sending a legally translated document.

- We cannot accept documents signed by someone related to you for example, your sister takes care of the child while you work. You can’t send a statement signed by your sister as the childcare provider to prove the child lived with you.

- You are using the same record or document to prove different things. For example, you use a school record to show the child attended school from January to May and then another record showing the same child attended from September to December during 2019. If the records show your address and list you as the parent, you can use the records to prove the child lived with you for more than half the year in 2019 and that the child is related to you. If the child is age 19 but under age 24, the records also prove the child is the right age

About Us

Mission Statement

The great mission of FreedomTAX is to use our 18 years of expertise to provide tax preparation services and tax bank products to meet the needs of our clients in the DFW area and across the nation. We prepare personal and business entity income taxes, help customers plan for future tax years in a way that minimizes any tax burden on the client, and provide tax bank products that help with the clients’ cash flow. Our aim is to make our clients take a sigh of relief by using our expertise in the tax code, using out tax bank products to help with cash flow, and plan for future tax years to make every tax year a great year. Our employees have multiple opportunities to advance their careers and feel invested in our business and the business of the clients.

Ownership Team

Our owners are Heather and Randy Lee both are Registered Tax Preparers and 20+ year Licensed insurance Agents. The insurance license can come into play when clients need to address future risks or explanation of insurance policies they own or require to purchase. They also operate an independent insurance agency. Our valued expert preparers are trained by Randy Lee, considered one of the best trainers in the industry having trained many our direct competitors.

Services and Products

What is the speed to fund market. These are clients that are expecting tax refunds from the IRS but would like to have access to those funds immediately or accelerated in some fashion. We provide bank products that advance up to $7,000 (Fast Cash Advance). Sometimes clients refer to this as rapid refund advance, holiday loan, income tax advance, instant tax loan, tax refund loan, same day tax loan, 24hour tax loan, tax refund anticipation loan. We only call it the Fast Cash Advance. Other bank products include: Refund Transfer (where the client receives the refund transferred to their bank account or in cashier check form or debit card issued in office as soon as the tax refund is funded by the IRS), Fast Forward (for an additional fee client can receive their money up to 5 days early. Example would be if IRS notifies us on a Friday of a tax refund effective Wednesday the money is available in your account immediately where the regular ACH process would take until that Wednesday).

Specialized Expertise

Specialized tax preparation markets of our family of individual preparers. This can and will include small businesses with sole proprietorship, LLC, LP, INC, S Corp, etc.. Other niche markets include day traders, clients with mark-to-market designations, clients that own multiple rental properties and might need a cost segregation study to accelerate depreciation, maximize tax refunds by analyzing how children are claimed on mothers’ or fathers’ as well as dozens of other methods. Individual preparers naturally become better at different types of returns as their career progress.

Your Tax Appointment

Bring all of your income documents. This would include W2, 1099Misc, 1099R, SSA, SSI, last paystub of the year, Self Employment docs, K-1, etc..In addition bring Photo ID, SS cards of all taxpayers & dependents. If you still don't know what to bring we will interview you over the phone and advise you what to bring. Your appointment can include tax preparation, tax service and refund loans.

Contact Us

Better yet, see us in person!

We love our customers, so feel free to visit during normal business hours for tax preparation, tax service and refund loans

Hours

Mon | 10:00 am – 08:00 pm | |

Tue | 10:00 am – 08:00 pm | |

Wed | 10:00 am – 08:00 pm | |

Thu | 10:00 am – 08:00 pm | |

Fri | 10:00 am – 05:00 pm | |

Sat | 10:00 am – 05:00 pm | |

Sun | Closed |

Photo Gallery

Contact Us

FreedomTAX

Hours

Monday - Friday: 10am - 6pm for appointments

Saturday: 10am - 5pm for appointments

Sunday: By appointment only